What Are Your Personal Retirement Goals?

Whether you want to kickstart your days of retirement by travelling the world or buying a sports car to drive around in style, adding to your personal pension pot each month could help you work towards your retirement goals.

Remember that retirement is the golden time of your life when you could do all you want (with no one to stop you) only if you have the required savings. For instance, you can start a small nursery that can become your source of income. Or you can simply shift to assisted living facilities in orlando or any other location if you want to. Besides this, if travelling the world has been on your bucket list for quite a long time, then this might be the time when you can get on a cruise and see the seven wonders of the world. Wait, do you want to buy a new house? If you have saved up enough money, why not buy one? As you can see that supporting a lifestyle, be it a lavish one like travelling around the globe or a simple plan like moving to Active adult apartments can need money. This is the reason why you need to set some financial goals before you retire. The best thing could be to save up a small amount of money every month in order to live a stress-free retirement life.

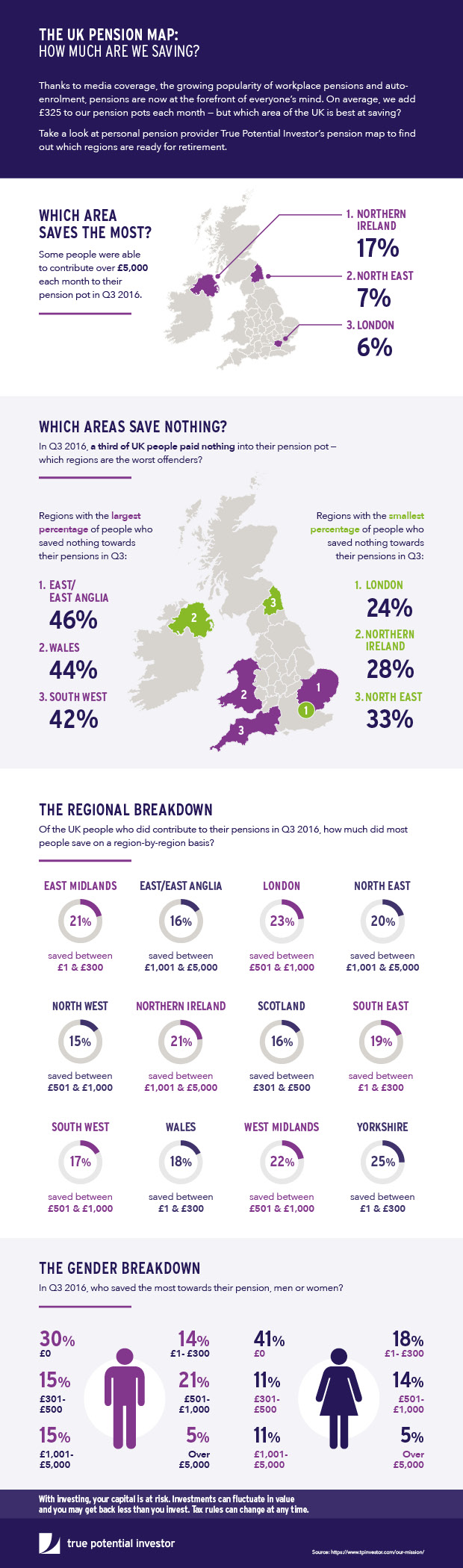

Findings from online investment firm, True Potential Investor, have revealed how UK regions are planning ahead for their retirement. However, it is not just the UK where people consider making retirement goals. People across the world, be it in the US or some other country, often consider conjuring up plans to effectively deal with their retirement lives.

Anyway coming back to the topic of the UK, according to research, during Q3 2016, 17% of people living in Northern Ireland were able to contribute over £5,000 to their personal pension accounts each month. How well your region preparing? Read on to find out more on how to have a safe retirement.